With the CBD market estimated to hit $22 billion by 2022, it’s best to understand the CBD marketing regulations that could stop you in your tracks.

At this point, only hermits and monks are unfamiliar with the story of CBD (cannabidiol), but few know about the CBD marketing regulations. In the last 12 months, CBD products have permeated the public consciousness much in the same way the “gluten-free” craze did a few years earlier.

Despite this market omnipresence, there’s still one thing we’re a bit foggy on — what U.S. consumers actually think about these products.

Fortunately, a recent GlobalWebIndex post took a deep dive into this issue and surfaced some remarkable insights.

Let’s take a closer look.

The CBD explosion

Cannabidiol, a hemp / cannabis byproduct, is non-intoxicating and has been associated with a variety of positive effects on health and wellness. For people looking for a more natural way to treat issues such as pain, anxiety or insomnia, CBD is an attractive proposition.

As such, the CBD market has seen extraordinary growth in recent years. One report estimates the CBD market alone could be worth $22 billion by 2022. One key to unlocking that growth is public perception.

GlobalWebIndex queried U.S. Internet users about their perceptions of CBD and found strong support for the market.

- 64% of respondents indicated they would be open to using CBD products

- 15% said they’d do so if stronger evidence of medical value existed

- Only 14% of respondents ruled out CBD completely

CBD sales get another boost because they are situated within a market that’s expanding at a rapid rate: Health and wellness. That market is now worth more than $4 trillion and has been growing at a rate of nearly 13% annually. Trends toward alternative medicine and self-care are underpinning this growth, as more people are seeking viable alternatives to pharmaceuticals.

Data from GlobalWebIndex shows that U.S. consumers place CBD squarely within this context:

- 65% of U.S. consumers associate CBD products with healthcare applications

- 37% associate CBD with food

- 28% associate it with beauty and personal care

The survey also found that most CBD users are deploying the product within a health and wellness regimen. More than half of respondents said they are using CBD to treat pain, stress, or an underlying psychiatric condition.

The regulatory evolution

Recent growth in the cannabis market is directly tied to loosened CBD marketing regulations. The 2018 U.S. Farm Bill allowed, for the first time, CBD and other hemp-derived products to be sold commercially. This move came on the heels of a wave of medical and recreational marijuana legalizations at the state level.

Consumer opinion backs up this regulatory evolution. More than half of those surveyed by GlobalWebIndex reported believing that all cannabis products should be legal, while another one-third support full legality for CBD and hemp, but not recreational cannabis.

Somewhat surprisingly, negative connotations associated with cannabis use were not a primary concern for those surveyed. Instead, most respondents expressed concern with consumer protection. Because CBD is ingested, it’s critically important to establish safeguards in terms of product safety and marketing.

Why marketing CBD is challenging

Google, Facebook, and other major digital ad platforms restrict the advertising of CBD products. Additionally, a web of media laws and CBD marketing regulations governing CBD marketing plans exists through different jurisdictions, limiting what marketers can do.

As the market matures, however, these rules are likely to change. Consumer attitudes indicate that finding the right CBD messaging is important:

- 56% of consumers want CBD health benefits to be stressed

- 46% want to see testimonials from health professionals

- 39% want testimonials from current users

- 37% want CBD’s “natural” status emphasized

- 33% want CBD’s legality promoted

- 29% want to see CBD promoted as a beauty product

- 25% want CBD showcased with food and beverages

There’s another marketing angle that makes sense in terms of CBD –premiumization. Research from GlobalWebIndex indicates 60% of consumers are willing to pay a premium for CBD-infused products.

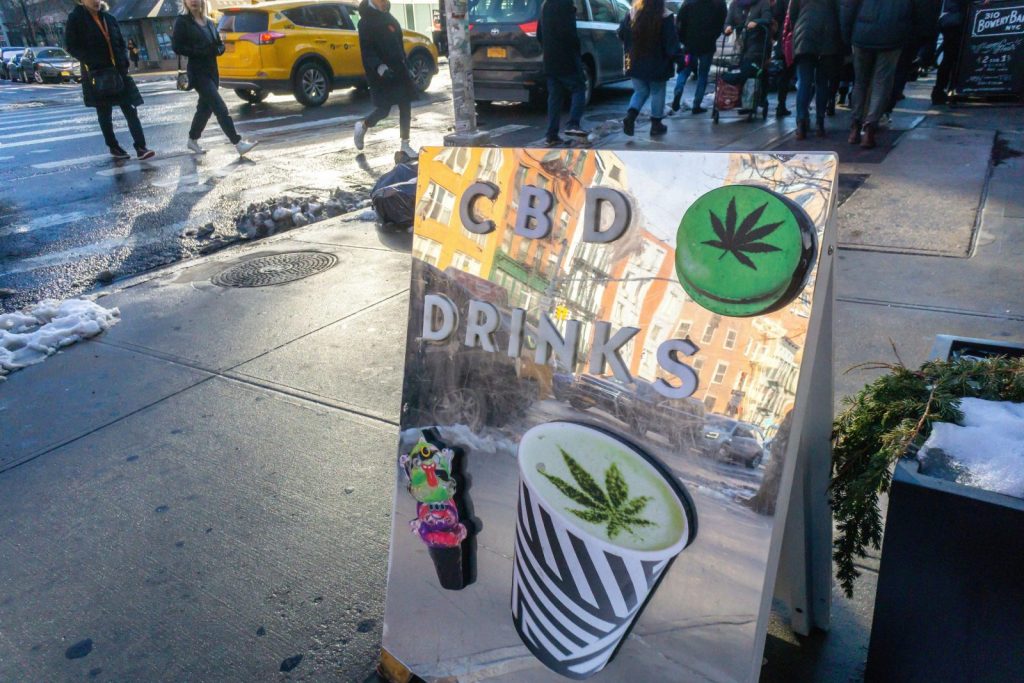

In larger, more cosmopolitan areas, CBD products are being marketed as a more upscale / healthy version of a standard coffee or chocolate bar. This strategy is likely to bear fruit, as consumers have long demonstrated a willingness to pay a premium for niche health products (gluten-free, organic, non-GMO, etc.).

The takeaway

At BIGEYE, we understand the challenges that come with cannabidiol and CBD marketing regulations. If you’d like to hear more about what a sophisticated CBD marketing campaign can do for your business, reach out to us today.